The words of the former actress beautifully capture the essence of how food enhances the travel experience, making it not just exceptional but also deeply enriching.

When we explore the culinary landscape of a new place, we embark on a sensory journey that connects us with the heart and soul of that destination.

Traveling is a remarkable endeavor in itself, offering the opportunity to immerse oneself in diverse cultures, landscapes, and experiences.

However, it is through food that the true essence of a place is often unveiled.

A Universal Language

Food is a universal language that transcends borders and allows us to connect with the heritage and traditions of a region in a deeply profound way.

Meghan Markle emphasizes the authenticity of the culinary experience. Tasting a genuine dish, prepared with time-honored recipes and local ingredients, is a revelation. It is like unlocking a secret portal to the heart of a culture.

When you savor an authentic Pad Thai on the bustling streets of Bangkok, you’re not just indulging in a meal; you’re partaking in a centuries-old tradition that reflects the flavors and stories of Thailand.

Have you heard of Bangkok based Gaggan Anand?

Similarly, enjoying a proper curry in India is a sensory journey through a kaleidoscope of spices, a culinary adventure that transcends the ordinary.

More Than A Sustenance

Food is more than sustenance; it’s a gateway to understanding, empathy, and appreciation.

It allows us to break bread with locals, to share stories over a communal table, and to bridge cultural gaps.

Through food, and colorful cuisine, we gain insight into a region visited country’s history, agriculture, climate, and the alchemy of its culinary traditions.

Food is a testament to the craftsmanship and passion of local chefs and cooks who take pride in preserving their culinary heritage.

For example, there is a modern thai inspired eatery.

These individuals invest their skills, love, and creativity into every dish they prepare, creating masterpieces that are deeply intertwined with the identity of their homeland.

Asia is home to a vast number of well-known restaurants that are able to satisfy a wide range of diners’ preferences and tastes because to the region’s extensive culinary history.

These culinary hotspots, ranging from restaurants serving fine dining to eateries serving street cuisine, are owned and managed in vibrant cities by people who are passionate about food and have made a significant imprint in the industry of restaurants around the world.

There are fine dining restaurants, street food eatery managed by locals, and even regionally inspired french cuisine.

Let us explore the world of prominent restaurants in Asia, from regionally inspired French cuisine to sustainable dining experiences, award-winning pastry chefs to pioneers of street food, and everything in between.

Here are some of the Popular Restaurants in Asia Owners

Most Popular in Asia #1: Chef Thitid ‘Ton’ Tassanakajohn’s

Thai chef and restaurateur Chef Thitid ‘Ton’ Tassanakajohn’s culinary journey began with a deep appreciation for the food prepared by his mother and grandmother during his childhood.

Despite initially pursuing a financial career and studying Economics at Chulalongkorn University, he later found his true passion in cooking.

This newfound passion led him to attend the Culinary Institute of America and subsequently open a series of successful restaurants, including Nusara, Baan, Mayrai, and Samut.

After completing his MBA in Hospitality from Johnson & Wales University and excelling in culinary training at The Culinary Institute of America, where he graduated at the top of his class, Chef Ton gained valuable experience working at renowned establishments such as Eleven Madison Park, The Modern, and Jean George, a Michelin-starred restaurant.

He also earned the title of Certified Sommelier from the Court of Master Sommeliers in New York.

Chef Ton has made significant contributions to Thai cuisine through his fine-dining restaurant Le Du, established in 2013, and a series of modern Thai restaurants that serve family-inspired recipes, including Baan, Backyard, and Baa ga Din.

Most Popular in Asia #2: Winning restaurant Le Du is a fine dining gem that has captured the hearts of epicureans.

Specializing in regionally inspired French cuisine with a Thai twist, Le Du seamlessly combines the sophistication of French gastronomy with the bold flavors of Thailand.

This culinary alchemy has earned the restaurant acclaim both locally and internationally, making it a must-visit for those seeking a fine dining experience with a twist.

Chef Hans Christian and F&B professional Budi Cahyadi, driven by a long-held dream, have achieved a significant milestone as their restaurant, August in Jakarta, has been awarded the prestigious American Express One To Watch Award ahead of the Asia’s 50 Best Restaurants 2023 event.

Restaurant le du is indeed a win.

Most Popular in Asia #3: Chef Hans Christian and Managing Partner Budi Cahyadi

Hans Christian, originally from Bandung in West Java and raised in Jakarta, is a passionate chef who embarked on a culinary journey, studying in Kuala Lumpur and later in Providence, Rhode Island.

During his time in the United States, he further refined his culinary skills by working in renowned establishments, including the one-Michelin-starred Next, part of the famous Alinea Group in Chicago.

It was in Jakarta that he crossed paths with Budi Cahyadi five years ago, and they quickly discovered they shared a common vision.

Most Popular in Asia #4: August offers a welcoming atmosphere for patrons to relax and unwind.

The establishment takes pride in its commitment to using exclusively fresh, locally sourced ingredients in crafting its culinary creations.

Through their meticulous service and attention to detail, the team at August strives to establish meaningful connections with their guests.

Without seeking to boast, August aspires to uphold the connotations associated with its name, aiming to be a revered and magnificent dining destination.

The global restaurant industry firmly believes that the key to creating a memorable dining experience lies not in the range of services offered, but in the quality of service provided to each and every guest.

August boasts an entirely Indonesian team that prioritizes collaboration with local producers, including farmers from Lembang and fishermen in Bali, Lombok, and Sumbawa.

They emphasize the use of locally sourced spices and ingredients in their cuisine.

Furthermore, August promotes Indonesian craftsmanship by exclusively using locally made ceramics, aligning with their mission to showcase the richness of Indonesia’s offerings.

Chef Hans Christian and Budi Cahyadi’s restaurant, August, in Jakarta, received the esteemed American Express One To Watch Award, recognizing their dedication to Indonesian cuisine and their commitment to working with local producers and artisans to highlight the nation’s culinary and cultural wealth.

Owned by a team of passionate culinary experts, August has gained recognition for its commitment to sustainability, earning special awards, such as the Sustainable Restaurant Award for its environmentally conscious practices.

Most Popular in Asia #5: Chef Louisa Lim

Singaporean Louisa Lim loved cooking from a young age. She studied at Paris’ Le Cordon Bleu culinary school. This change transformed her as she immersed herself in French delicacies and saw their passion to their profession. Inspired by the French enthusiasm and accuracy in pastry-making, she pursued her own culinary goals.

Lim learned from Mathieu Pacaud at Hexagone and Histoires, two famous Parisian restaurants. She went from intern to pastry commis in a year and a half.

Lim then tackled her next assignment at Pacaud’s flagship restaurant, Apicius, where she redesigning the dessert menu.

Her Singaporean ethnicity and French culinary knowledge make her a natural pastry chef at Odette.

Chef Julien Royer led Odette at the National Gallery Singapore to Asia’s Best Restaurant in 2019 and 2020. Louisa Lim joined Odette in 2019 to work with Royer to reinvent the dessert menu.

Female chef Lim’s specialty is making sweets for Odette’s international clientele.

By contrasting flavors, she achieves harmony and balance. Her delicacies, such the Ardèche Chestnut, a modern take on Mont Blanc, are meticulously made.

This dessert with rich chestnuts, Corsican clementines, and toasted hazelnut meringue is beautiful and tasty.

Louisa Lim’s work at Odette has helped the restaurant succeed. Her deserts end the meal with a light, engaging, and refreshing touch. In 2023, she won the best pastry chef award.

Most Popular in Asia #6: Street Food Eatery in Ho Chi Minh City, Vietnam

Ho Chi Minh City’s street food culture is a vibrant part of Asia’s culinary landscape.

Many street food eateries, though humble in appearance, are managed by skilled chefs who have perfected their craft over generations.

These hidden gems offer a taste of authentic Vietnamese cuisine and are an integral part of the local food scene.

Most Popular in Asia #7: Another fine dining scene is Bangkok restaurant Nusara

It offers a fusion of traditional Thai and modern culinary techniques, creating a unique dining experience.

Nasara’s innovative approach has attracted both local and international food enthusiasts, solidifying its place in the global restaurant industry.

If you are into food, Villar City is the right home for you.

The said Brittany community is near numerous food establishments.

Furthermore, Vista City Alabang offers an array of exquisite high-end residential properties, ranging from spacious bungalows to multi-level mansions.

Each home is thoughtfully designed to cater to the unique preferences of its owner, featuring a blend of contemporary and traditional architectural styles.

These homes are characterized by sleek lines, elegant finishes, and modern amenities that prioritize comfort and convenience.

Suggested Read: Savoring Summer: Exploring The Best Of Santa Rosa’s Culinary Scene

Suggested Read: How To Effectively Manage A Business From Home

Suggested Read: Choosing Your Investment Property

Suggested Read: Why Should You Choose City Living

Suggested Read: Culinary Pilgrimage in Laguna

Purchasing a real estate investment can be one of your most accomplished goals in life. To have a house you can call your own is a dream come true. Living in a luxury house is the best part, but no one can skip the steps prior to landing into your doorstep. This phase could be daunting and overwhelming- from house-hunting, document processing, payments, and even after sales, these are a lot to chew. Thankfully, real estate developers alongside digital evolution find ways to make the experience easier, simpler, and faster for its future home owners.

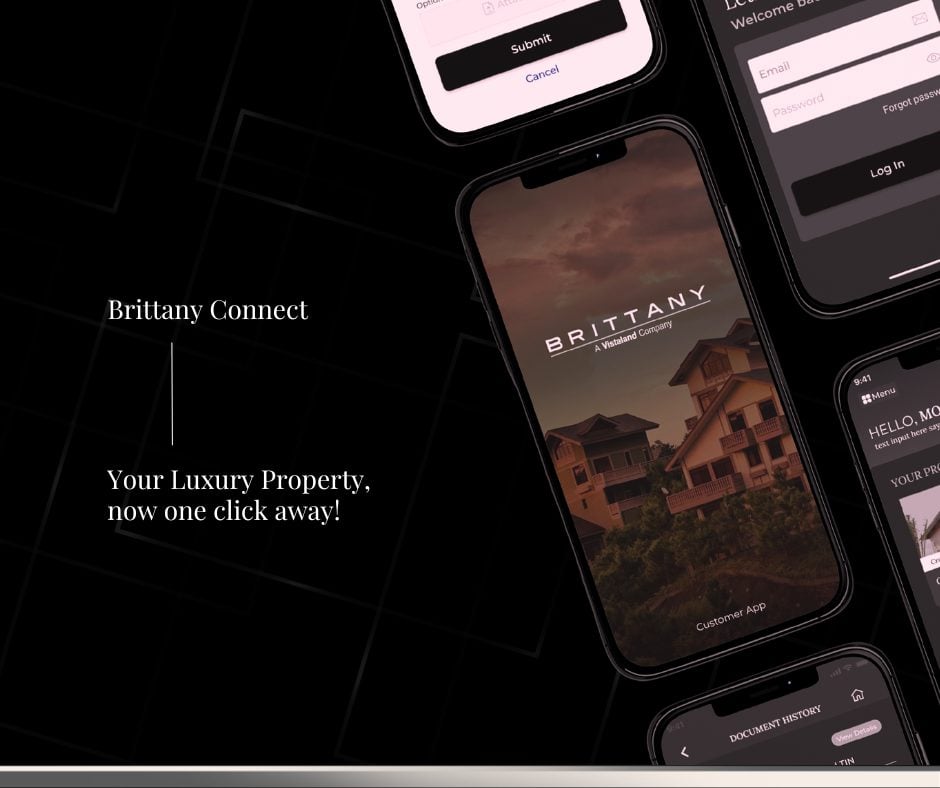

Brittany Corporation is on the move to providing a seamless journey to your real estate acquisition. Worry no more because Brittany customers is lucky to experience the new and advanced Brittany Connect for a streamlined monitoring of their purchased properties until turnover. Stay up to date with this digital addition to your real estate experience.

What is Brittany Connect?

As part of the innovation in technology, Brittany Corporation has birthed one of the best real estate apps in today’s housing industry, and it has YOU in their mind.

YOU MATTER. This is BRITTANY CONNECT. This real estate digital app is taylor made to home buyers’ usual concerns about their properties- document submission and management, payment process, and housing progress, etc. The Brittany Connect App is like your direct line to your real estate developer whenever, and wherever you are in the world equipped with tools and features to help you.

Customer service at it’s finest is the core of this real estate digital app, making a positive and effective customer service experience. No need to send long emails, or engage to endless calls, this real estate digital app has the ability to provide services in your convenience.

How Do I Log In to the Brittany Connect App?

Like any other mobile apps, Brittany Connect App is very easy to use.

All Brittany Home Owners are qualified to have an account with the Brittany Connect App. To create and access your own account, you simply follow these three easy steps.

- Contact your Account Officer to request for a portal access. The account officer will send you an invite through the email you provided in their system.

- Check your email to see the invitation from your account officer. This should direct you to your log-in detail where you will be asked to customized your password. Once password is changed, users are to choose “DOWNLOAD” to eventually access the mobile app.

- Once downloaded, choose the property developer where your purchase is part of and log-in with your account details.

Note: Any concern, or inquiry don’t hesitate to ask your account officer for they are willing to get your through each and every step of the process.

How to Navigate the Brittany Connect App?

As soon as you downloaded the Brittany Connect App, you now have the access to up to date information in the platform. You just have to log-in, and see for yourself the new features of this

What Can I find in the Brittany Connect App?

1. PROPERTIES

Online Property Viewing

Once you log-in you will be directed to the landing page of the this digital real estate app. One of the features of this platform is you get to track your properties listed on the real estate digital app of Brittany Corporation. It is very convenient to stay on the loop to check on the progress, and essential information of your purchase.

When you select a certain property you will then be directed to these following information for your reference.

- Sales Order (SO) Number

- Property Name

- Block & Lot

- Address

- Unit Number

- Property Status

- Usage Type

- Unit Type

2. DOCUMENTS

Document Management

The Brittany Connect will also lessen your document processing hurdles as it will organize and guide you for the next step. In this real estate digital app, you can already see uploaded documents, and document still pending for submission.

- Submitted Documents- In this tab, you will be able to see the documents you already submitted. These were uploaded automatically on the system for easier and faster access by your account officer.

- Required Documents – For instance, there are still documents you need to submit, this tab will notify you of the requirements for your compliance. You can see here the comprehensive list of must-provide documents to settle your account. If all documents are already passed, you will no longer see any list for submission.

How to Upload Documents?

- To upload documents, you just have to “Select File to Upload”. You can select through the drop-down menu for guidance and options.

- Attach your selected file and upload.

- Click ‘Submit’. Clicking submit doesn’t guarantee that file is already uploaded. A pop-up notification box will be seen on the screen stating that file uploaded will be validated first by your Account Officer.

- All submitted documents are subject for verification and acceptance of your Account Officer on the site.

3. HELP DESK/SUPPORT

Raising Issue Through Ticket Creation

One of the most important features of the Brittany Connect is the ability to raise your issue or concern to your account officer without visiting their office physically. This feature allow users and property owners to relay their property concerns immediately by creating a ticket.

Spot any problem? Create a ticket right away to help your developer fix the problem. Simply click the ‘I Need Help’ button located at the bottom. Fill out the needed information.

- Ticket type

- Ticket subject

- Ticket description

- Attached image (You can attach a file to support your concern. This is optional.)

Once information are completed, you will be notified about the success of your ticket creation.

Note: If there is already an existing ticket with the same type, you can no longer create such ticket. Tickets must be resolved first before creating same ticket type.

4. APPOINTMENT

Appointment Booking or Schedule Meetings

This feature of the Brittany Connect is very helpful especially for busy people. This can be found on the Menu Bar on the upper right of the app. Just click “Appointment”. You no longer have to wait on long ques on call because you can book a meeting in seconds. Click “Book An Appointment” and choose the most convenient time for you based on the calendar provided.

- Select Property

- Select Location

- Select Appointment Type (Document Signing, House Inquiry, Payment, Document Request, Title Concern)

- Select Appointment Time (Date & Time)

- Note (This is optional but make sure to write a note if you need any document so your account officer can prepare right ahead)

Conclusion

Brittany Connect is created for Brittany Home Owners to enjoy the properties and the experiences connected with it. Navigating through this real estate digital app may help every home owner to be connected to its real estate developers and to its community. Whether you are an android or IOS user this is good news for you!

Embrace this change added to your real estate investment journey. Embark to this new technology to streamline process and secure the success of your property acquisition. Be part of our Brittany Connect community. Purchase your first real estate investment with us. Visit Brittany Corporation’s website to get to know more about Brittany’s property listing.

Engage, and thrive with Brittany Connect app where innovation meets real estate. Your Luxury Property, now one click away!

Tradition and modernity coexist harmoniously in the city of Seoul, which serves as the capital of South Korea, a thriving metropolis known for its dynamic blend of old and new.

Amidst the bustling streets and towering skyscrapers, there exists a treasure trove of hidden gems waiting to be uncovered by design connoisseurs.

If you have a passion for interior design and are always on the hunt for one-of-a-kind and visually stunning home furnishings, then Seoul’s Korean lifestyle shops, concept stores, and shopping malls should be on your must-visit list.

In addition to its well-known K-pop culture and delectable street cuisine, Seoul is also a utopia for individuals who appreciate the art of interior design and the aesthetics of home decoration.

The city’s shopping districts and local artists have cultivated a unique design scene that caters to a wide range of tastes and preferences.

an extraordinary fusion of modern and traditional aesthetics

Seoul’s shopping malls, concept stores, and department stores, drawing inspiration from the nation’s rich cultural heritage.

These establishments are more than just places for customers to make purchases; rather, they are carefully curated havens where creativity, tradition, and innovation converge.

What’s exciting is you can find South Korea’s largest wholesale in a shopping mall, no doubt!

From the latest trends in the luxury goods showcased in upscale department stores to the artisanal creations of local artists found in concept stores and art galleries, Seoul’s design landscape offers a diverse array of options for discerning shoppers.

South Korea can indeed be considered a shopping district.

Exploring Seoul’s shopping districts can easily fill an entire day with captivating discoveries.

Whether you are seeking inspiration for your own living space or simply wish to immerse yourself in the world of Korean design, these shops and art galleries hold the key to a unique and enriching experience.

So, let us begin our exploration of these Korean lifestyle shops, concept stores, shopping malls, and art galleries that beckon design enthusiasts from around the world, ready to enchant and enthrall with their unparalleled beauty and innovation.

Here are some Korean lifestyle shops in Seoul that home design enthusiasts should visit:

Korean Lifestyle Shops in Seoul #1: Chapter 1

Tucked away on a quiet side street adjacent to Garosugil, Chapter 1 awaits discovery just down a steep staircase, far from the bustling crowds.

This hidden gem lies beneath the ground level, and it was born out of the owner’s passionate dream to create a haven where her affection for local living brands and designer items could converge harmoniously.

In this enchanting store, that dream has become a beautiful reality.

At Chapter 1, the balance between foreign and local brands is nearly equal, offering a diverse selection for visitors.

Yet, what sets this multi-shop apart is its exclusive line, sourced from Andong, a city known for its rich cultural heritage.

Among these unique collections are Jandam, featuring exquisite wooden and brassware creations, and Naknak, which draws inspiration from the graceful jujube tree.

These collections infuse a distinctive Korean essence into your dining experience.

If you’re seeking an alternative to the typical European-style dishware, Chapter 1 beckons you to explore its world of handmade and enduring tableware.

Here, you’ll find pieces that not only adorn your table with elegance but also tell a story of craftsmanship and dedication, making every meal a memorable experience.

So, for those in search of artisanal dishware that transcends the ordinary, a visit to Chapter 1 is a must.

Korean Lifestyle Shops in Seoul #2: DDP Design Store

The DDP Design Store, run by the Seoul Design Foundation, is an excellent introduction to Korean design and culture generally. ”

We carefully select outstanding designs and crafts and provide support to the creators,” said Rhee Kyung-don, the foundation’s chief executive officer.

They hope that this would help the people of Seoul reclaim their culture and strengthen their sense of community.

The Blank Project is well-known as a collection that interprets Korean culture and aesthetics through a modern lens.

Pebble Hwatu, as part of the Blank Project, adapted the traditional plant iconography seen on Hwu cards (a Korean card game) into the lovable pink bear mascot Bellygom.

This fresh take on a classic feature makes it an exceptional find.

Korean Lifestyle Shops in Seoul #3: Seoul Bund

The Seoul Bund embodies the vision of serving as a gateway for Asian treasures, allowing them to both enter and depart from Seoul.

Its primary focus is on Asian treasures, not only those originating from Korea but also from various parts of Asia.

Park Chan-ho, the founder and CEO of Seoul Bund, expressed regret that while people primarily use Western products in their daily lives, items infused with their own cultural heritage were often perceived as expensive art pieces, creating a disconnect.

Seoul Bund has curated a remarkable collection of up to 180 unique Asian collectibles, each with its own distinctive identity rooted in compelling narratives, materials, and practicality.

The diverse selection includes pieces from the locally beloved brand Geochang Yugi, which has preserved its special techniques for over a century.

It also features creations by the brassware virtuoso Lee Jong-oh and the lacquer master craftsman Park Gang-yong.

These objects exemplify the seamless integration of finely crafted items into our everyday lives, showcasing how craftsmanship can elevate the functionality and aesthetics of everyday objects.

Korean Lifestyle Shops in Seoul #4: HAHOUSE

Nestled in the vibrant neighborhood of Itaewon in Seoul, HAHOUSE stands as a testament to contemporary lifestyle stores and creative spaces.

The unique establishment, conceived by the local interior design firm niceworkshop, seamlessly weaves together the essence of minimalistic design with the studio’s signature steel furniture series.

Hyunseog Oh, one of HAHOUSE’s shop owners, offers us deeper insights into this intriguing project.

HAHOUSE, at its core, is a haven for enthusiasts of lifestyle, fashion, craft items, and furniture.

The primary objective of this endeavor was to craft a space that not only showcases the curated pieces but also harmoniously integrates the distinct design language of nice workshop.

What sets HAHOUSE apart is the meticulous attention to detail evident in its interior elements.

From the sliding doors to the bespoke furniture, handles, and lighting fixtures, the majority of these components were painstakingly customized.

Rather than relying on off-the-shelf solutions, much of the hardware was meticulously crafted, contributing to the creation of a space that exudes a sense of complete and thoughtful design.

Among the standout features of HAHOUSE, Hyunseog Oh highlights niceworkshop’s Affordance series as a personal favorite.

This series derives its name from the concept of inducing human behavior: the inherent and external properties of a particular object trigger specific actions in users, establishing a profound connection between utility, function, and interaction.

Noteworthy is the innovative approach taken with the sliding door.

Unlike conventional sliding doors, HAHOUSE’s design exposes the door’s bearings, which serve both functional and aesthetic purposes.

This ingenious twist on a familiar element not only adds to the beauty of the visual appeal but also enhances the overall user experience within the space.

In essence, HAHOUSE is more than just a store; it is a meticulously designed environment where form and function converge seamlessly.

It serves as a testament to the creative vision of niceworkshop and offers visitors a unique and immersive experience in the heart of Seoul’s dynamic Itaewon district.

With its bespoke craftsmanship and innovative design concepts, HAHOUSE stands as a shining example of how thoughtful interior design can elevate the perception and utility of a space.

Korean Lifestyle Shops in Seoul #5: Lotte Department Store

Lotte Department Store in Seoul is one of the city’s most prominent and iconic shopping destinations. Located in the heart of Seoul, Lotte Department Store offers a vast array of high-end products, fashion brands, luxury goods, and more, catering to the discerning tastes of both locals and tourists.

The Department Store is known for its upscale shopping experience.

It is meticulously designed to provide a luxurious atmosphere that enhances the overall shopping experience.

Shoppers can find a wide range of international and domestic brands, from fashion and cosmetics to electronics and home goods.

Lotte Department Store is a one-stop destination for those looking for top-notch products and designer labels.

Lotte Department Store in Seoul is a symbol of luxury and sophistication, offering a premium shopping experience for those seeking high-quality products and a taste of upscale Seoul living.

Brittany Corporation, synonymous with excellence in real estate development

The Brittany promise is one of exceptional craftsmanship and service, setting new standards in property development.

With a commitment to creating the greatest urban landscapes globally, Brittany enables families to turn their dreams of luxury living into reality through uniquely themed homes that nurture lives.

Amidst this dedication to excellence, there exists a harmonious partnership with Korean interior design that can elevate the allure of your Brittany home.

Korean interior design is renowned worldwide for its distinctive blend of tradition and modernity, a marriage of aesthetics that mirrors Brittany Corporation’s vision.

As you explore the possibilities of enhancing your Brittany home with Korean furniture and interior design elements, you embark on a journey where elegance, functionality, and cultural richness converge.

Suggested Read: 2023 Korean Visa Requirements And What Filipino Travelers Need To Know

Suggested Read: Home With Water Features For Aesthetics

Suggested Read: The World’s Most Visited Cities for Travel

Suggested Read: Best Architectural Home Designs

Suggested Read: The Aesthetics Of Glass Houses

2023 has seen improvements in the prices of condos for sale and for rent in Metro Manila. One would recall that during the start of the pandemic, the demand for houses in the Philippines, luxury condo, and high end residential property went down, as people had to stay home and economy went down, among other reasons. 2020 may have been a depressing year for real estate, but it is a different story for 2023.

The presence of condos in Manila contributes significantly to the country’s economy and helps Filipinos lead more prosperous lives. This is evident considering the population density of Manila. People go to the city, hoping to get into good schools and find high-paying jobs. Given the competition in the condominium market, condos in Manila are expected to be affordable.

Students and young urban professionals make up most of the people who buy condos, so condo prices should not be unattainable. Condos are also a secure option when it comes to housing. For a low monthly rent, residents of a condo building get round the clock security and surveillance. A lot of investments also come from the real estate sector, driving economy forward. Real estate proves to be a pretty stable market, now that the country has reached a point wherein COVID 19 is no longer a medical emergency.

Now, real estate is stable again, due to demand primarily and market recovery post quarantine. Experts observed steady demand as more and more people have been going back to offices and schools again, and then there is also the offshoring of foreign workers. In the next section are the factors that affect the price recovery condo Manila and some business and consumer sentiments, in detail.

Condominium Price Recovery in Manila

The ride in demand for condos in the Philippines are influenced by the following factors:

Economic Growth

Economic recovery typically leads to increased consumer confidence, higher incomes, and job stability. As people’s financial situations improve, they are more inclined to invest in real estate, including condos. A growing economy can boost demand for condos as people seek to upgrade their living arrangements.

Manila condominium price goes up as workers go back to the workplace again. Employees went back to their provinces at the beginning of the COVID-19 pandemic, causing condos for sale to go down in prices. Now, in addition to everyone going back to the city, successful businesses even offshore employees from other nations, further bolstering the demand for condos and houses in the Philippines.

Urbanization

The Philippines has been experiencing rapid urbanization, with many people moving to urban centers for better job opportunities and amenities. Condos are often seen as a convenient and practical housing option in urban areas, which can drive price recovery condo Manila.

Not only do people move in to the city for better job opportunities, like logistics and manufacturing industries. Big cities also have more quality colleges and universities, which is why condos get sold year after year and new buildings with condos for sale get built regularly.

Foreign Investment

A recovering economy can attract foreign investors looking for real estate opportunities. Foreign buyers are interested in purchasing condos in the Philippines, particularly in popular tourist destinations or major business districts. A luxury condo in a beautiful location, such as Crosswinds Tagaytay, will always be a worth it investment. You can stay there anytime with your family or even rent it out to other people as a business.

Check out Brittany Corporation if you are looking for a high end residential property in a prime location as a business opportunity. Remember, the price of condos for sale is bound to rise as economy improves.

Low Interest Rates

Central banks may keep interest rates low during an economic recovery to stimulate borrowing and investment. Low interest rates make it more affordable for individuals to finance condo purchases, potentially increasing demand.

Tourism and Hospitality

The recovery of the tourism and hospitality sector can also condominium price recovery in Manila. Condos can serve as both residential and vacation properties, making them attractive to investors and tourists.

Lifestyle Changes

The COVID-19 pandemic prompted some lifestyle changes, with more people seeking larger living spaces or homes with outdoor areas. However, condos with innovative designs that cater to changing lifestyles (e.g., home offices, communal spaces, and recreational facilities) could remain attractive.

Condos for Sale Pricing

Now if you have decided to buy or invest in a condo, given the growing demand for them, here are some of the things that affect how much your condo should be. Also, these are the things you should consider depending on how you will use the condo unit:

1. Location Matters

Condo prices vary significantly depending on the location within the Philippines. Major urban centers like Metro Manila, Cebu, and Davao typically have higher condo prices compared to suburban or rural areas outside of Metro Manila, because they are near good job opportunities and good schools, among others. Condos in the Makati Central Business District are high in prices, because they are in high end residential property and in a prime location.

2. Property Type

Condo prices can also vary based on the type of property, such as luxury condos, mid-range condos, or affordable housing. Luxury condos in prime locations tend to be more expensive, for obvious reasons.

3. Square Footage

Manila condominium price is often quoted per square meter. Larger condos with more square footage will naturally cost more than smaller units. Get your family a spacious condo from Brittany Corporation. They have condos in the most beautiful areas of the Philippines like in Crosswinds Tagaytay and Bern Baguio. The pre selling residential demand is going up, so better check out some units soon.

4. Amenities and Facilities

Condos with extensive amenities and facilities, such as swimming pools, gyms, security services, and parking, tend to have higher prices.

5. Market Demand

Market demand and economic conditions can also impact Manila condominium price. In a strong real estate market, prices may rise, while economic downturns can lead to price stagnation or even decreases. Better get a condo as soon as possible, because the pre selling demand is bound to go up in the following years.

6. Developer Reputation

Condos built by reputable developers may come at a premium compared to those from less-established companies due to factors like quality and reliability.

7. Market Trends

Property prices can be influenced by various market trends, including supply and demand dynamics, interest rates, and government policies related to real estate. As explain in this article, the demand for condos is going up, which is what drives price recovery condo Manila.

Conclusion

Manila condominium price is steadily going up this year and it is expected to increase in the following years, as the economy of the country recovers. Condominium price recovery in Manila is a good sign for real estate workers and should be an encouragement for those who can afford to invest in real estate. A more dynamic property sector should tell companies to launch more residential projects.

Are you interested in condos and houses in the Philippines in a high end residential property? Make sure to give Brittany Corporation a chance. They have a lot of premium units on offer for the privileged few. Reward your family with a home that you deserve while Manila condominium price still have not reached sky high levels.

Make sure to follow Brittany Corporation on their social media accounts, so that you will be updated about their thematic offerings. They have Facebook, YouTube, Instagram, and LinkedIn accounts.

Suggested Read: Corporate Recovery And Tax Incentives: The More You Know

Suggested Read: Rising Demand For Luxury Properties: Wh0’s Buying

Suggested Read: Five Factors To Consider Before You Buy That Condo

Suggested Read: Luxury Housing Demand Rises: Outlook Stays Bright

Suggested Read: Economic Recovery Forecast for 2022

A living space truly lights up when there’s a touch of surprise. Whether it’s an intriguing decoration or a surprising choice of materials, adding something unique can bring thrilling energy to your home. And it gets even more exciting when there’s a captivating story or hidden meaning behind the things you choose to include in your space.

Take, for instance, the Pontevedra Estate in Santa Rosa City, Laguna. It’s a fantastic blend of modern and historical elements in a mixed-use development. Read on to know how you can work and play Pontevedra Santa Rosa.

Work And Play in Pontevedra: When Heritage Meets Modern Luxury

Inspired by an enchanting Spanish riverside town that seamlessly blends history, culture, and style, Pontevedra emerges as a 34-hectare estate in Santa Rosa, Laguna, where the fusion of old and new is celebrated. This remarkable development encompasses residential and commercial properties that embody modern design, timeless elegance, and a rich, artistic heritage legacy.

Pontevedra Estate in Santa Rosa stands as a masterpiece, boasting interlocking lanes, charming squares, and vibrant plazas adorned with cafes and unique culinary concepts.

A Captivating Estate with a Mission-Style Flair

Drawing inspiration from the mission-style architecture reminiscent of the Mediterranean region, Pontevedra harmoniously blends with the contemporary essence of its surroundings, including the local climate and lifestyle.

Featuring an elemental material palette, characterized by warm rubble and cut stone, complemented by exquisite carved wood accents and earthy terracotta roof tiles, the architectural style of the charming Pontevedra estate is simple yet functional. With its soft arches, inviting outdoor patios, and elegant stone terraces, the very charming Pontevedra estate exudes rustic charm, allowing the craftsmanship to shine through the finished materials and surfaces.

Exploring on Foot, Unveiling Delights

In parallel with its Spanish namesake, Pontevedra creates an atmosphere of a serene and secure community where every destination is just a step away. Each district within the estate boasts its own main courtyard, pulsating with life and defining a secure community with its unique character.

The interconnected streets are adorned with parks, tree-lined avenues, fountains, and lush gardens. The facades of establishments proudly display coats of arms, while bustling squares and vibrant pavement cafes create a lively ambiance. Meanwhile, the commercial district features stunning stone-and-glass buildings adorned with potted greenery, seamlessly integrating with the environment as you leisurely stroll along the streets.

Pontevedra invites future residents to embark on a captivating journey of discovery, encouraging exploration of its distinct districts on foot. Immerse yourself in the most emblematic squares, savor the atmosphere of the streets, indulge in delectable gastronomy, and unravel the true essence of modern city views its intimate community.

Distinctive Characters and Personalities

Each district in Pontevedra possesses a distinct character, brimming with life, passion, creativity, and joy.

Aveiro by Pontevedra: Work And Play in Pontevedra in this Mesmerizing Ambiance

An upcoming exclusive high-rise vertical village, Aveiro by Pontevedra, promises to the city’s urban life and deliver the epitome of luxury living. Immerse yourself in a symphony of nature and architecture, waking up to the melodious tunes of birds, the harmonious hum of human voices, and the gentle clink of coffee spoons. Throughout the residential building, pocket gardens are artfully scattered, while private balconies embrace the exterior, creating a serene oasis.

Viento by Pontevedra: Work And Play in Pontevedra in this Picturesque Patios Galore

Gracefully adorning the horizon of Sta. Rosa, Laguna, Viento by Pontevedra consists of a collection of low- and mid-rise residential and office buildings, set amidst open courtyards and beautifully landscaped gardens. The design ensures that internal spaces remain open, allowing the breeze to permeate and natural ventilation to flourish. Viento offers a space for gathering, interaction, private spaces, and unparalleled experiences, all complemented by breathtaking views.

Vizcino by Pontevedra: Work And Play in Pontevedra in Proximity to Vibrant Communities

Santa Rosa City in Laguna has become a thriving urbanized region, enriched by modern infrastructure and property developments. Vizcino by Pontevedra breathes life into a surrounding neighborhood brimming with shopping opportunities, restaurants, retail spaces, and office buildings. As the estate’s growth center, Vizcino will feature generously sized commercial areas that have commercial and retail businesses and foster a dynamic environment for ventures and entrepreneurial pursuits, seamlessly complemented by residential communities and transport hubs.

Valenza: Work And Play in Pontevedra while Harmonizing Modernity and History

Nestled within the bustling city, Valenza stands as a 22-hectare residential community within Pontevedra. It offers a haven of peace amidst the vibrant surroundings, complete with a quaint semi-enclosed garden. Valenza presents an impressive array of homes within a charming neighborhood, providing residents with luxurious amenities such as a pool, pocket gardens, and a basketball court. It offers the perfect balance of serenity and security while keeping the comforts of the busy city just within reach.

Segovia: Work And Play in Pontevedra in A Culinary and Architectural Delight

Embarking on a mission to encapsulate the urban essence of the city, Segovia emerges as a mixed-use project that seamlessly combines condominiums, offices, and restaurants. Live, work, play—this lifestyle is effortlessly facilitated within Segovia. Located within the Pontevedra estate, just a few blocks from Ramblas, Segovia offers modern city views while paying homage to classical Spanish design. It serves as an ideal retreat, emanating rustic luxury in every detail.

Huesca: Work And Play in Pontevedra in this Gateway to Enchantment

Situated in the captivating Pontevedra estate, Huesca emerges as a residential building exuding nature’s charm, magic, and captivating contrasts. As a string of buildings that gracefully follow one another, Huesca acts as the gateway to the vibrant city below, inviting strolls along its scenic promenades.

The Iconic Strips

Pontevedra’s pedestrian-friendly streets beckon future residents to embark on shopping expeditions while leisurely strolling, indulging in the local commerce and nearby amenities. These iconic strips feature comfortable, green spaces, fostering a friendly cultural promenade that offers ample pedestrian areas. Luxurious shops quiet cafes and charming establishments warmly welcome residents and guests, creating an inviting atmosphere.

Ramblas: Where Celebration Knows No Bounds

Within such a busy city cozy and convenient radius at Ramblas, endless options for enjoyment await. From delightful cafes for a tranquil evening start to unique culinary experiences and late-night entertainment, Ramblas offers a vibrant and unforgettable journey through the night.

La Unidad: Embracing Nature’s Splendor

Stretching across Pontevedra’s diverse districts, La Unidad presents a kilometer-long line of parks, linking Viento to Aveiro while seamlessly connecting the estate’s waterways with landscaped footpaths and captivating water features. Future residents can relish the opportunity to explore the community, bask in the natural surroundings, and admire the scenic beauty that La Unidad has to offer. The landscape is adorned with a variety of plants, meticulously arranged to create layers of color and texture, evoking a lush tropical ambiance.

Brittany Corporation: Redefining Luxury Living

Brittany Corporation stands as the premier residential and leisure division of Vista Land & Lifescapes, Inc., the largest homebuilder in the country. With an unwavering commitment to excellence, Brittany offers an exquisite range of home designs, high-end condominiums, and lot-only properties in prime locations.

Pioneering Luxury Communities

Brittany’s impressive portfolio includes esteemed developments such as Portofino in Alabang, Forresta in Daang Hari, Augusta, and Georgia Club in Santa Rosa, Laguna. These exclusive communities boast meticulously crafted homes that epitomize luxury, blending impeccable design with unparalleled comfort and sophistication.

Captivating Destinations

Crosswinds in Tagaytay and Bern in Baguio exemplify Brittany’s dedication to creating extraordinary living experiences. Nestled amidst nature’s splendor, these developments offer a tranquil escape from the bustling city, while providing residents with breathtaking views and unparalleled serenity.

Setting New Standards

With a relentless pursuit of innovation and a deep understanding of the discerning tastes of its residents, Brittany continuously raises the bar for luxury living. Each property showcases meticulous attention to detail, unparalleled craftsmanship, and a commitment to providing a lifestyle that exceeds expectations.

Experience the Essence of Luxury with Brittany Corporation, where visionary design, exceptional craftsmanship, and prime locations seamlessly come together to create a life of unparalleled elegance and comfort.

Connect with Brittany Corporation Today

You make check our LinkedIn, Youtube, and website to take a peek at Brittany’s luxurious homes that are only sold for a fraction of the price.

Suggested Read: 2023 Philippine Theater Play Performances To Watch Out For

Suggested Read: Pontevedra Future Developments in Santa Rosa, Laguna

Suggested Read: Pontevedra Accessibility Features That Stand Out

Suggested Read: Why Pontevedra Has The Best Green Spaces

Suggested Read: Lifestyle Centers In Pontevedra Santa Rosa

What causes the storm anxiety of dogs?

As thunder rolls and lightning flashes, many dogs cower, tremble, and seek solace during storms.

The phenomenon of storm anxiety in dogs is a common occurrence that stems from a combination of natural instincts, heightened senses, and learned associations.

Understanding why dogs get scared during storms is essential for empathizing with their fear and implementing effective strategies to provide comfort and support.

Dogs possess highly developed senses, including hearing, smell, and sensitivity to changes in atmospheric pressure. During a thunderstorm, these senses are bombarded with overwhelming stimuli.

The sharp cracks of thunder, the sudden flashes of lightning, the amplified sounds of rain, and even the static electricity in the air can create a disconcerting sensory experience for our canine companions. The intensity of these stimuli can trigger a fear response and contribute to their anxiety.

Dogs are capable of forming strong associations between events, environments, and emotions.

If a dog experiences a traumatic event during a thunderstorm, such as a close encounter with lightning or a loud noise that startles them, they may develop a lasting fear response. This learned association between storms and negative experiences can intensify their anxiety with each subsequent storm.

Dogs have excellent memory recall, and past fearful encounters can heighten their anticipation of future storms, exacerbating their anxiety.

The fear response to loud noises and sudden environmental changes, such as thunderstorms, can be traced back to the evolutionary survival instincts of dogs’ ancestors.

In the wild, sudden loud noises often indicated a potential threat, such as a predator or approaching danger. Dogs have inherited these instincts, and their fear response during storms can be seen as a way to protect themselves from perceived threats.

Many dogs have a heightened sensitivity to sounds, making them more prone to experiencing storm anxiety. Certain breeds, such as retrievers, collies, and hounds, are more predisposed to sound sensitivity due to their genetic makeup.

Additionally, dogs with age-related hearing loss or those who have experienced trauma or abuse may be more susceptible to storm anxiety. The combination of their acute hearing abilities and sound sensitivity can amplify their fearful response during thunder storms.

Dogs are highly empathetic creatures and can pick up on the emotions and behaviors of their human companions.

If a pet owner displays fear or anxiety during a storm, their dog’s fearful behavior may mirror those emotions, further intensifying their own anxiety.

Dogs rely on their owners for guidance and reassurance, so maintaining a calm and composed demeanor during storms can have a positive impact on their emotional state.

Understanding why dogs get scared during storms enables pet owners to implement strategies that can help prevent and manage their anxiety.

Creating a safe space within the home where dogs can retreat during storms, such as a cozy corner or a crate covered with a blanket, can provide a sense of security. Using a white noise machine, classical music, or television at low volumes can help drown out the noise of the storm and provide a calming effect.

Behavioral conditioning techniques, such as gradually exposing dogs to recorded thunderstorm sounds and rewarding calm behavior, can help desensitize them to storm-related stimuli. Natural remedies, such as lavender oil or calming treats, can provide additional support.

In severe cases, consulting a veterinarian for anti-anxiety medications may be necessary to alleviate their anxiety during stormy weather.

When dark clouds gather and lightning flashes across the sky, many pet owners find themselves in the midst of a common challenge—keeping their furry companions calm during storms.

Dogs, with their acute senses and sensitivity to loud noises, often experience storm anxiety, making it essential for pet owners to understand their dog’s body language and employ effective strategies to provide comfort.

When the storm starts, your dog may feel trapped, so make sure to stay calm and keep in mind these calming remedies.

How To Keep Your Pet Calm #1: Keep Creating a Safe Haven

During a storm, dogs often seek a safe place where they can feel secure. Designate a safe space in your home where your dog can retreat to when anxious. This area should be free from windows and as soundproof as possible.

You can dampen the noise of thunderstorms by playing white noise or classical music at a low volume. These calming sounds can distract your dog from being afraid of the scary noises outside.

How To Keep Your Pet Calm #2: Behavioral Conditioning

A thunderstorm conditioning program can help desensitize dogs to storm-related stimuli. Gradually exposing your dog to recorded thunderstorm sounds at a low volume, while engaging them in positive activities like play or treats, can help them associate storms with positive experiences.

Over time, you can gradually increase the volume to desensitize your dog further. This process should be done in a controlled and positive manner.

How To Keep Your Pet Calm #3: Natural Remedies

Several natural remedies can have a calming effect on anxious dogs. Lavender oil, known for its soothing properties, can be diluted and applied to your dog’s bedding or diffused in the room.

Calming treats or toys designed specifically for anxiety can provide a distraction and help your anxious dog relax. Additionally, ensuring that your dog receives regular exercise and mental stimulation can reduce overall anxiety levels.

How To Keep Your Pet Calm #4: Veterinary Assistance

In severe cases of storm phobia, where natural remedies and behavioral techniques may not suffice, it may be necessary to consult a veterinarian. A vet can recommend anti-anxiety medications to help manage your dog’s anxiety during stormy weather.

Medications should be used under the guidance of a professional and in combination with behavioral strategies.

How To Keep Your Pet Calm #5: Safety Measures

During storms, dogs can experience heightened sensitivity to static electricity and changes in air pressure. To alleviate their anxiety, providing a grounding mat or grounding toys can help discharge static electricity.

Ensuring that your dog’s collar or tags do not carry a static charge can also make them more comfortable. Additionally, avoid leaving your dog outside during a storm and ensure that they have access to a sheltered play area.

Other Dogs and Humans

If you have multiple dogs, they can provide comfort and reassurance to each other during a storm. Their presence can be a source of security, so allowing them to stay together can be beneficial.

Similarly, having humans present can help dogs feel safe and more at ease. Dogs often look to their human companions for guidance and reassurance, so staying calm and composed during storms can have a calming effect on your pet.

Sometimes, the vet recommends medication to help the thunderstorm anxiety of your dog.

During storm season, remembering these tips can help your dog indeed.

Besides thunderstorms, other dogs can also fear the noise of fireworks. So make sure to know the tips how to calm your dog. Noise aversion from fireworks can be distressing for our furry friends.

Manage noise aversion in dogs during fireworks displays, including the use of TV, providing shelter, helpful hiding spots, and addressing their fears.

You can also have a bed for your dog to calm them.

Brittany Corporation, renowned for its innovative luxury home communities,

Brittany Corporation has consistently aimed to create exceptional living spaces that offer a unique and sophisticated experience.

Alongside the remarkable architectural designs and scenic inspirations, the inclusion of pets as valued members of these communities can enhance the overall appeal and lifestyle offered by Brittany Corporation in the Philippines.

Pets, particularly dogs and cats, have long been cherished companions known for their unwavering loyalty and unconditional love.

By highlighting the presence of pets in Brittany Corporation’s luxury home communities, potential residents are immediately drawn to the idea of having a faithful and devoted companion to share their lives with.

The joy, comfort, and emotional well-being that pets bring can be an enticing factor for those seeking an enhanced living experience.

Suggested Read: Natural Disaster Safety Advice: How To Stay Safe Inside Your Home

Suggested Read: Glass House Appeal in Luxury Real Estate: Why Are They Popular

Suggested Read: How To Spend National Dog Day at Home

Suggested Read: Color Influence on Our Emotions

Suggested Read: How To Create A Cozier Home

House hunting can be an exciting and daunting task. It’s an opportunity to find your dream home, but it can also be overwhelming with so many factors to consider.

House hunting is an exhilarating journey that marks a significant milestone in one’s life. Whether you are a first-time homebuyer venturing into real estate, a growing family in search of a larger space, looking to build wealth, a young professional looking for a new home, or a buyer seeking a new chapter in a different location, the quest for the right home is a thrilling and sometimes daunting endeavor.

It’s a process that blends dreams with practicality, aesthetics with budgeting, and emotions with logistics. As a buyer who embark on this adventure, you’ll explore a myriad of properties, each with its unique charm and character, while navigating the intricacies of the housing market. Join us on this exciting voyage as we delve into the art and science of house hunting, uncovering the secrets to finding that special place where dreams meet reality.

But of course, with every adventure, there will always be problems to be faced when searching for the perfect home.

What Makes Luxury Home House Hunting Difficult?

House hunting can be a challenging and sometimes frustrating process for several reasons:

-

Location Preferences

Finding a house in your desired neighborhood or school district can be difficult, especially if the area is in high demand. Location often plays a significant role in the price, home values, and availability of homes.

-

Timing

The real estate market can fluctuate, and timing your search with favorable conditions can be tricky. Houses may come on the market at inconvenient times, or you might feel pressure to make a quick decision in a competitive market.

-

Emotional Attachment

House hunting for home buyers can be an emotional process, as buyers often become attached to certain properties. This emotional investment can make it difficult to make objective decisions in home values and may lead to disappointment if a deal falls through.

-

Negotiation and Competition

Negotiating the price and terms of a home purchase can be complex, especially in competitive markets. Facing multiple offers or dealing with stubborn sellers can add to the difficulty.

-

Changing Market Conditions

Market conditions can change rapidly for home buyers, affecting the availability of properties and their prices. Staying informed about market trends is essential but can also add complexity to the process.

House hunting requires patience, flexibility, and the ability to adapt to changing circumstances. Working with a knowledgeable real estate agent can help alleviate some of these challenges by providing expertise and guidance throughout the process.

So what exactly do you do in the face of these challenges?

Luxury Home House Hunting: Tips & Tricks

Investing in a luxury home is a big decision for home buyers, and it’s important to do your research and be prepared. From researching to finding the perfect property, here are some tips & tricks that can help you:

-

Do Your Research.

Before you start house hunting, take some time to research the luxury home market in your area. This will help you learn about the different types of homes available, the average prices, and the current market conditions.

-

Be Prepared To Act Fast.

Luxury homes often sell quickly, so you need to be prepared to act fast when you find one that you like. This means having your financing in order and being ready to make an offer.

-

Work With A Qualified Real Estate Agent

A good real estate agent can be invaluable when you’re buying a luxury home. They will have access to exclusive listings and can help you negotiate the best price.

-

Consider Exclusive Listings.

Not every luxury home is listed on the MLS. Some sellers prefer to keep their properties under wraps, which means you’ll need to work with a real estate agent who has access to exclusive listings, and has working knowledge on MLS Listings and asking price for different properties.

-

Pay Attention To The Details.

When you’re looking at luxury homes, it’s important to pay attention to the details. This includes things like the finishes, the appliances, and the landscaping.

Of course, there are other factors and things to consider when going luxury home house hunting.

Enter The Digital Age

In today’s digital age, technology has revolutionized the way we search for luxury homes, , reshaping the entire landscape of real estate exploration and acquisition. Gone are the days when prospective buyers had to rely solely on traditional methods like driving through upscale neighborhoods, flipping through printed property listings, or engaging in time-consuming consultations with real estate agents.

The advent of the internet and its continuous evolution has bestowed upon us a powerful arsenal of digital tools and platforms, each playing a pivotal role in this revolution and aiding people in the home buying process. Online real estate listings websites have become virtual treasure troves, where a plethora of luxury properties from around the world can be browsed with just a few clicks. High-resolution photos, immersive 3D virtual tours, and detailed property descriptions allow buyers to get an in-depth feel for a home without setting foot inside.

Paving The Way For Technological Advancement in Real Estate

Ranking among these technological advancements are Property Listing Websites. Property listing websites play a crucial role in simplifying this process.

Property listing websites play a pivotal and indispensable role in streamlining and simplifying the complex and often overwhelming process of buying, selling, renting, or investing in real estate. These digital platforms have revolutionized the way individuals and businesses interact with the property market, offering a multitude of benefits and conveniences that were previously unimaginable.

What’s The Best Property Listings Website in the Philippines?

Looking to buy properties? The best property listings website in the Philippines depends on your specific needs and preferences. However, one of the most popular real estate websites is AllProperties, a real estate marketplace and property listing platform in the Philippines. It is owned and operated by Vista Land & Lifescapes, Inc., the country’s largest real estate developer.

What is AllProperties?

AllProperties offers a wide variety of properties for sale and rent, including houses and lots, condominiums, townhouses, apartments, and commercial properties. It also provides a variety of services to help buyers and sellers find the right property, such as property valuation, mortgage financing, and home insurance.

AllProperties is a convenient and easy-to-use platform for finding and buying real estate in the Philippines. It has a user-friendly interface and a wide range of features, making it a great choice for both buyers and sellers.

What Makes AllProperties One of the Best Real Estate Websites in the Philippines?

-

Wide Variety of Listed Properties.

You can find lots, houses and lots and condominiums on AllProperties.

Brittany Corporation offers a variety of lot properties in different locations in the Philippines. Here are some of them:

- Portofino Villar City is a luxury residential development located in Alabang, Muntinlupa City. It has a variety of lot sizes, ranging from 300 square meters to 1,000 square meters. The development is also home to a number of amenities, such as a clubhouse, swimming pool, and tennis court.

- Pievana is a luxury residential development located in Santo Tomas, Batangas. It is surrounded by natural beauty, such as mountains and forests. The development has a variety of lot sizes, ranging from 300 square meters to 1,500 square meters.

- Pontevedra Estate is a luxury residential development located in Santa Rosa City, Laguna. It is a historical site that has been restored and converted into a modern residential community. The development has a variety of lot sizes, ranging from 300 square meters to 1,000 square meters.

- Augusta is a luxury residential development located in Cainta, Rizal. It is a gated community with a number of amenities, such as a clubhouse, swimming pool, and tennis court. The development has a variety of lot sizes, ranging from 300 square meters to 1,000 square meters.

- Lausanne at Crosswinds is a lot-only development in Tagaytay City. It is located in a quiet and peaceful area, making it a great place to relax and unwind.

- Alpine Villas at Crosswinds Tagaytay is a luxury condo development in Tagaytay City. It is inspired by Swiss chalet villages and offers stunning views of the Taal Lake and the surrounding mountains.

- The Grand Quartier at Crosswinds is another luxury condo development in Tagaytay City. It is located in the heart of Crosswinds Tagaytay, making it a convenient place to live, work, and play.

- Bern Baguio is a luxury condo development in Baguio City. It is located in a quiet and peaceful area, making it a great place to escape the hustle and bustle of the city.

- A nature-inspired mixed-use development is rising in the urban south. Forresta is a 118-hectare mixed-use estate at Villar City in Alabang, which offers contemporary homes and modern hubs in serene, natural settings.

- More than just a tourist destination, Crosswinds Tagaytay elevates the mountainous retreat experience you expect in the City of Character that keeps Tagaytay refreshed.

In addition to these different types of properties, AllProperties also has a variety of filters that you can use to narrow down your search. You can search by location, price, size, number of bedrooms and bathrooms, and more. You can also search for properties that are pre-selling or ready for occupancy.

To find a property on AllProperties, you can either browse through the listings or use the search bar. Once you find a property that you are interested in, you can contact the seller or developer for more information.

-

Listings Made by Reputable Real Estate Professionals

This means that you can be sure of the authenticity and quality of the properties posted in AllProperties.

-

Website-Friendly Interface

You can easily filter the properties by house prices, location, size, and other criteria.

-

Wide Variety of Features

AllProperties offers a variety of features to help you find the perfect property. For example, you can create a saved search, get email alerts for new listings, and contact the property owner directly through the website.

Conclusion

Overall, AllProperties is a great option for anyone looking to buy or sell real estate in the Philippines. It is a safe, secure, and convenient way to find the perfect property.

AllProperties is a prime example of how technology is revolutionizing the real estate industry. As more stakeholders come to appreciate the benefits of streamlined processes, improved communication, and data-driven decision-making, platforms like AllProperties are likely to become increasingly essential in property management in the years to come.

We are in a generation where technologies continue to emerge and evolve. Its pace is taking a vast acceleration to which people are expected to learn and adapt. Our era is characterized by the convergence of digital, physical, and biological technologies, and it is reshaping various aspects of our lives and industries. And today, as of September 2021, we are officially in the Fourth Industrial Revolution or Industry 4.0.

The Philippines has been making efforts to foster technology innovation and advance its tech ecosystem in recent years. And just recently, a Joint Memorandum Circular (JMC) has been signed by the Department of Science and Technology (DOST) and the Philippine Economic Zone Authority (PEZA) to establish university technology hubs or technohubs.

DOST-PEZA Universities TEchnohub: What is the role of DOST and PEZA?

The Department of Science and Technology or DOST’s main function is to guide, oversee, and organize the nation’s technological and scientific initiatives with a focus on maximizing economic and social advantages for the general public.

Meanwhile, the role of Philippine Economic Zone Authority (PEZA) is to stimulate investments, provide help, register investors, provide incentives, and facilitate their business operations in locations across the nation that are suitable for export-oriented manufacturing and service facilities.

Together, they aim to invest knowledge in students that could potentially change the country’s economy. Their target is to establish technohubs on colleges and universities with spare land that focus on the key elements of today’s innovation which are robotics, artificial intelligence (AI), and big data.

DOST-PEZA Universities TEchnohub: Memorandum of Understanding (MOU) on the establishment of ecozones in State Universities and Colleges

Government agencies claim that ecozones at state universities and colleges (SUCs) can improve the growth conditions for startups and micro, small, and medium-sized businesses (MSMEs) by utilizing specialized academic spaces for regional research and development (R&D). The Department of Science and Technology (DOST), the Philippine Economic Zone Authority (PEZA), and the Philippine Association of SUCs (PASUC) signed a memorandum of understanding (MOU) on the creation of ecozones in SUCs on Thursday.

The goal of the knowledge, innovation, science, and technology (KIST) ecozones and parks is to mobilize academia and various industries for focused R&D initiatives and future global dissemination of technologies and goods.

The MOU came after the joint memorandum circular to develop KIST ecozones in SUCs and higher education institutions was signed by the DOST and PEZA on August 3. It was released to establish the standards and processes for assessing registration applications and administering incentives to KIST developers, operators, and locators.

Technohub in Universities: The Vision

The two agencies envision a Philippines KIST park for higher education institutions. KIST stands for “Knowledge, Innovation, Science, and Technology”. One of the newest special economic zones (SEZs) under PEZA are KIST parks.

Increased research and development infrastructure, engagement with international partners, technology transfer, and the upskilling of our workforce toward innovation will all be significantly aided by KIST parks. According to Tereso Panga, director general of PEZA, if these hubs are administered effectively, they might spur economic growth throughout the entire nation. Biotechnology, food and nutrition, agriculture, engineering, electronics, robotics, renewable energy, transport solutions, data analytics, and artificial intelligence are among the priority fields for research and development. Sancho Maborang, the DOST Undersecretary for Regional Operations, expressed optimism that DOST technohub will help the country’s citizens find employment and develop more homegrown innovations.

Another vision for the KIST parks is this: In an effort to draw foreign students and transform the Philippines into an education hub of Asia, KIST Parks will also allow universities to collaborate with foreign universities to bring their degree programs, skill development, and technology to their local KIST partners.

KIST Ecozones

One of the goals of the KIST Ecozones is to turn HEI-owned vacant land into a more productive usage that serves STI needs. The registration and administration of financial and non-financial incentives for KIST Ecozone Developers/Operators and Locators, including start-up and spin-off businesses, must also be covered by this clause. The high-value intellectual capital and physical resources of the selected universities and colleges will be extremely beneficial to PEZA-registered businesses at the KIST Parks.

Furthermore, it should also act as a focal point of competence where ideal circumstances for innovation and business and startup companies are created by conducting a partnership among the public sector, educational institutions, corporate affairs, and the community at large.

The KIST Ecozones also aim to have an active possibilities for businesses as well as startup companies to conduct business in an exclusive economic zone and take advantage of monetary and non-fiscal incentives, that were established under the Corporate Recovery and Tax Incentives for Enterprises law and the Innovative Startup Act.

Lineup of the DOST – PEZA Universities Technology Hub

Around 44 universities and colleges have expressed interest in creating KIST parks, with the objective of specializing on the strengths of each state university, according to DOST Secretary Renato Solidum Jr. Here are the official and lined up universities that will host a KIST park.

-

Batangas State University (BatStateU)

BatStateU’s Park in Batangas is the first KIST park in the Philippines. The reason why is because the university is is without a doubt the prime location for technology transfer and commercialization in the Philippines due to its advantageous location close to other technological parks, economic centers, and transportation systems in the CALABARZON Region. It will foster and accelerate the growth of new high-tech firms, make it easier for university expertise to be transferred to locator companies, support the development of faculty- or student-based spin-offs, and stimulate the development of novel products and processes. It is envisioned as the nation’s premier seedbed and enclave for technological innovation.

Its virtual launch last 2020 has a theme “Towards a New Frontier of Knowledge-building and Innovation in Science & Technology” that intends to lead smart city networks and environmentally friendly industrial townships in Southern Luzon. A data center, a design innovation facility, and a technological hub are among the amenities of the park. It is leading an extended effort to expand state universities and colleges in the Philippines’ programs for industry, education, market collaboration, technopreneurship, startup development & acceleration focused on innovation, and knowledge co-creation in science and technology. As they lead green industrial townships and smart city networks in Southern Katagalogan and the whole province, everything will be put into motion with the help of this joint initiative from PEZA and BatStateU.

-

More Approved KIST Parks in the South

The De La Salle University Innovation Hub in Biñan, Laguna, University of Perpetual Help’s AltaHub in Cavite, and Lyceum of the Philippines-Laguna KIST Park are now approved and ready to arise. In order to find new patents and prototypes that will enable the commercialization of ecozone high-tech projects, we are anticipating the establishment of more technohubs. These parks will provide an environment that is conducive to research and development (R&D) and innovation.

-

Catanduanes State University (CatSU)

Just this May 2023, the State University in Catanduanes of the Bicol Region conducted a groundbreaking ceremony of its KIST park and Agro-Industrial Economic Zone. CatSu Kist park is set to change an estimate of 263,000 citizens’ lives.

CatSU is able to mobilize the cooperation of farmers, NGOs and business chambers, scientists and researchers, and key players in the information technology and agro-sector supply chains as these examples of ecozones conform to green, inclusive, and sustainable development, fostering synergies between business and the academic community. And it is worth mentioning that these innovations are estimated to bring in a total of PhP 1.550 Billion investments.

Conclusion

Everybody wants to go with the latest trends of technology innovation . It may be hard to understand, but everything can be learned especially by adapting to lifestyle and having the influence from other people.

Brittany Corporation is here to assist you in finding and developing the ideal luxury lifestyle you desire while having a modern living, bonus is the properties are near to the KIST parks mentioned!

Live in Crosswinds Tagaytay’s pine tree forest. Brittany Santa Rosa will show you how to live the English aristocratic lifestyle in Promenade. Enjoy life to the fullest while living the La Posada lifestyle in San Francisco. Or maybe experience Portofino Alabang’s Italian beauty from the European era.

Suggested Read: Universities in CAR Excel in Top Innovative Universities Rankings

Suggested Read: Startups And Entrepreneur Hub: Discovering The Davao Hub

Suggested Read: Baguio Innovative Healthcare: Why It Matters

Suggested Read: Top Schools And Universities Near Laguna

Suggested Read: Wondering Where You Should Move To?

In this day and age, earning passive income has become much more prominent.

Passive income strategies have been steadily increasing as people of all ages become more interested in earning passive income alongside their main source of income.

What is Passive Income?

Knowing the differences and similarities in active and passive income streams can be life-changing for those in the working class. Each one has their own traits, so it’s important to know beforehand which one suits you more.

From the name itself, passive income is a way of generating money without having to work directly. This is the main difference which separates it from active income, wherein workers have to expend a certain amount of time and energy in order to generate an income.

Passive income streams are often riskier due to its unpredictable nature; however, it also comes with greater rewards. Many people strive to have a passive income, especially in their later years where time and energy may be limited.

Real Estate as a Passive Income Streams

The best Passive income ideas often revolve around one industry: real estate.

If you want to put some cash in your high yield savings account, real estate investment is one of your best chances at doing so. Real estate investment is one of the most popular ways to generate passive income for some extra cash.

Real Estate Investment Trusts (REITs)

Real estate investment trust companies are the optimal passive income streams for those who wish to enter the real estate industry without having to bring out their own cash for buying properties.