BLOGS

About The Vista Land Real Estate Investment Trust

You might have heard that putting your money in a real estate investment is a smart choice, and for the most part, that’s true. But what exactly is a real estate investment trust, and how does it work?

This article will discuss everything you need to know about real estate investments, Vista Land’s real estate investment trust, and how you can invest in it for a better financial future.

What is Real Estate Investment?

Investing in real estate is a great way to grow your money. © Unsplash

Real estate is a technical term for land-based properties, including the land itself and everything that sits on it. These could be natural items, such as trees or water sources, or man-made, such as houses and roads.

There are at least five broad categories of real estate: residential (used for houses for people to live on), commercial (used for business spaces), industrial (such as factories), raw land, and special use. Real estate investment is any money that you invest into a real estate or real estate-related venture, with the expectation that it will appreciate and give you profit in the long run. There are many kinds of real estate investments. You can either purchase or invest in real estate directly, such as buying a home, leasing out the land, or putting a commercial space for rent.

However, you can also invest in real estate indirectly through a real estate investment trust or a REIT. Although it’s less involved, REITs are an easy, painless way to invest in the real estate market without being mired in the day-to-day minutiae of owning physical property.

This makes investing in REITs very accessible to beginner and passive investors. That said, there are still a few more things you need to know about REITs, so that’s what we’re going to talk about most in this article.

Suggested Read: Post-Pandemic Financial Forecast | Brittany Corporation

Explaining Real Estate Investment Trust

A real estate development in Egypt. © Unsplash

Essentially, a real estate investment trust is a mutual fund for the real estate industry. Investors pool their money together, and a company invests the pooled money into some form of actual real estate investment. The profits from that investment are then distributed to the shareholders of the trust.

With this model, an investor can earn from their real estate investments through profit appreciation or dividends. REIT companies typically own other real estate. They could also specialize in a certain real estate sector. For example, if a REIT company specializes in commercial spaces, it may own commercial complexes, parking lots, healthcare facilities, and other buildings used for business.

However, companies could also invest in more uncommon forms of real estate investments, such as energy companies, fiber cables, signal towers, and even healthcare facilities, disposal sites, or a diverse mixture of all of those. The possibilities are vast in the real estate industry.

Unlike mutual fund plans, REITs are publicly traded in the market. This means, for example, that you can buy and sell REITs in the Philippine Stock Exchange (PSE). REITs are generally traded in very high volumes and thus are considered liquid investments.

Suggested Read: Everything You Need to Know About VUL Insurance | Brittany Corporation

Benefits and Downsides of Investing in a REIT Plan

Real estate includes residential properties like houses and condos. © Unsplash

Such a complex tool as a real estate investment trust will have many pros and cons. This section will examine each of their good and bad points to understand this financial instrument fully.

Benefits

Better liquidity

A REIT is traded on the stock market just like normal stocks. Of course, it’s not as liquid as having your money sit in a bank, but it’s far more accessible compared to investing in a real estate property.

Actual properties can be difficult to sell or increase in value, especially if there’s a recession. Of course, that doesn’t include luxury real estate whose value will always appreciate over time. That said, with this, you only need to wait a few hours or days to either liquidate or pour more money into your REIT.

Diversification

Even at its least diverse, such as a REIT company specializing in a specific sector, a real estate investment trust will still invest in multiple properties at once. The risk is split among different properties and can better weather whatever market upset comes its way.

Compared to that, an investment in a physical property will be more difficult to manage during market shake-ups, as they are more directly affected.

Transparency

A REIT company regularly updates shareholders about its accounts as part of its policy. They do these through reports that contain statistics and analytics that essentially show you how your investments are performing.

Meanwhile, it’s harder to own physical real estate investments yourself, as you have no one else to help you keep track of all the numbers.

Stable cash flow through dividends

Dividends are the shareholder’s part of the REIT company’s gain. The dividends rate seldom changes so that you can expect a stable rate of return. This constant rate is because companies are obliged to pay the stockholders first regardless of what happens.

On the other hand, the cash flow on physical properties depends on many things and is often not as stable.

Attractive risk-adjusted returns

A risk-adjusted return refers to the potential profit you’re going to get from your investments after it has been adjusted for all the relevant risk factors. The traditional view is that high-risk investments are synonymous with high gains, and low-risk investments produce low yields.

While that’s often true, REITs offer considerably better rates. Although they are pretty conservative risk-wise compared to owning actual real estate, they still provide a relatively greater rate of return.

Downsides

Although it’s a good plan, there are also downsides to investing in a REIT. © Unsplash

Slow growth

REITs have longer maturity periods compared to more common financial instruments. In general, the real estate industry can be rather slow-going, although it’s certainly more secure than most other industries.

Add to that the fact that it’s more vulnerable to market changes than your run-of-the-mill stock, which we’ll discuss in the next item. Suffice to say, if your aim is short-term growth, it’s better to look elsewhere.

More vulnerable to market changes

All investment vehicles are subject to market changes, but REITs are more vulnerable to these. This is because REITs have physical assets as investments, which are directly affected by trends.

For example, if your REIT company has a portfolio of salon holdings or arcade games, then your REIT investment is going to take a strong hit should salons or arcade games fall out of fashion for any reason.

Dividends are taxed as regular income

Usually, the dividends you get from financial vehicles such as stocks and bonds are taxed at a much lower rate than income tax. This is not true for REITs. REITs are usually taxed more or less at the same rate as a regular income.

What’s the Vista Land REIT Plan?

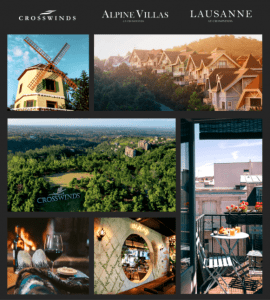

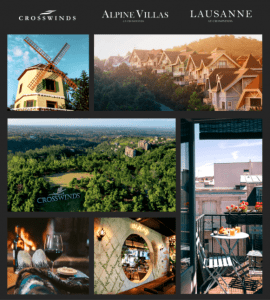

Some of Brittany’s developments, which are under Vista Land.

So far, there are only three REITs in the Philippines; Ayala Land Inc’s Real Estate Investment Trust (AREIT), Double Dragon’s REIT (DDMP REIT), and Filinvest’s REIT (FILRT).

However, Vista Land, the umbrella company that encompasses all Brittany developments, plans to float their REIT offering this 2021.

According to Manuel Villar, Vista Land’s chairman, the REIT that VLI is planning to offer contains office buildings, shopping centers, and residential properties in its portfolio. The Villar group disclosed that office spaces consist of about 15% of their leasing portfolio, which have remarkably remained in business even during the pandemic. The rest of its holdings mostly come from malls.

More than its existing assets, Vista Land is eager to add to its REIT portfolio and are thus ramping up the construction of their various projects around the country to increase their offering.

Why Invest in the Vista Land REIT Plan?

Modern Classic Home: Eliot | Promenade, Santa Rosa, Laguna | Mansions in the Philippines

Vista Land’s planned REIT is set to become a strong contender for the Filipino people’s interest in the real estate market. With a portfolio of strongly performing office buildings and retail malls that have remained in good business even throughout the pandemic, investors will be assured of the attractive risk-benefit ratio this REIT offers.

Vista Land, Brittany’s parent company, is a leading property developer of mansions in the Philippines. It’s also one of the country’s largest homebuilders, with total assets worth P282.0 billion as of March this year.

Moreover, it has land holdings of about 2,953 hectares and a 5-billion peso investment in various projects for this year alone. Recent reports have indicated that the company built six high-end projects, two mid-rise buildings, and three affordable projects. This strong asset value ensures that the company has many resources to fuel market moves and future growth.

Also, despite being down by 14% at the end of the year’s first quarter because of the pandemic, this real estate developer has seen continuous growth in the past months. As of August, the company’s net income has reportedly gone up by 9%, driven by strong demand from OFW investors that have retained their fire even amidst the Covid-19 pandemic.

Even then, the company is looking to drive further growth. One of their more adaptive initiatives includes increasing their online presence. The chief executive Manuel Paolo Villar disclosed that the company is strengthening its digital initiatives, which entails creating an online reservation system, expanding its online payment system, virtual tours, and social media presence.

Brittany’s parent company shows a strong drive for growth and reliable management that seeks growth even in the most difficult situations.

How to invest in Vista Land REIT Plan?

The exterior of the Italian-inspired Antonello, a luxury house model at Portofino Heights.

As of the moment, Vista Land’s REIT still isn’t being offered to the public, although it could easily come out this year or the next. Nevertheless, it’s easy to invest in real estate investment trusts offered by Brittany’s esteemed parent company.

REITs are traded in the stock market, much like regular stocks. This means that you can purchase REIT shares through a broker.

There are a lot of different online stock brokers in the Philippines. The best ones are COL Financial, First Metro Securities Brokerage Corporation (FMSEC), and bank-based brokerages such as BPI Trade and BDO Securities.

The application process for each online brokerage depends on the company. You are generally required to submit a fully accomplished registration form, valid IDs, a TIN, and an attached bank account. There might be a waiting period of a few days to get your account verified.

After that, you can simply direct money to your online broker account and then purchase REITs as you would regular stocks.

You can also own REITs by investing in pooled funds, such as retirement accounts or mutual funds that include REITs in their portfolio.

Lastly, investors have the option of putting money into unit investment trust funds that include overseas REITs in their portfolios. This means that, like mutual funds, companies pool investor capital and invest them into REIT companies overseas. These overseas companies will then own physical real estates such as luxury houses and lots and commercial properties outside the Philippines.

These UITF includes BDO Developed Markets Property Index Feeder Fund and various Manulife Asia-Pacific REIT Fund of Funds classes.

Investing in the Vista Land Real Estate Investment Trust

The Quadrille luxury house model at La Posada is situated in a charming San Francisco-inspired community.

A real estate investment trust fund or REIT is a great investment opportunity in the real estate sector. This fund pools investor capital and invests it in various physical assets, such as houses and lots, commercial, industrial, and utility properties.

This can be much better than investing in physical real estate yourself, where you have to develop or put up properties for sale. That’s because REIT is a more diversified, transparent, and profitable way of investing in the real estate sector.

Here at Brittany corporation, we believe in a rewarding future for the Philippines’ real estate industry. As such, we continue to develop the most beautiful houses in the Philippines in various locations all over the country, such as Tagaytay, Alabang, Santa Rosa, and Sucat. These high-end developments contribute to the market strength that Vista Land’s future REIT offering will surely display.

Up Next: A Look At The Brittany Salesforce Rewards Circle

Up Next: Top Luxury Destinations to Visit in Your Lifetime

Up Next: Real Estate Investment Mistakes to Avoid | Brittany Corporation