BLOGS

‘BBB’ credit rating: Everything To Know

Credit rating is a vital part of your financial identity. It’s important to know where you stand so you can make intelligent decisions about what you can afford and how to get there. This guide will help you understand what you need to know about ‘BBB’ credit rating and the factors that go into getting a good credit rating.

Credit can be like the weather: it’s easy to ignore, but if you don’t keep an eye on it and take appropriate action when problems arise, you may get caught in a bad situation.

When you have a good credit score, life is much easier—you can get higher loans for cars, houses, and apartments, as well as find work as an employee or contractor. But when you have a bad one, things can be challenging: You may have trouble getting loans for anything, which means you’ll need to save up or pay out of pocket for everything from cars to houses.

This article will help you learn what a credit score is, how different factors affect your score, and how you can improve your credit score to take advantage of the many benefits of having a good credit score.

What is a credit rating?

A credit rating is a number or letter representing an individual’s or company’s financial strength including credit risk. They are used to determine how likely someone is to pay back a loan and what interest rate they’ll have to pay on it.

The primary purpose of a credit rating is to measure the risk of lending money to an individual or organization. This lets lenders know how much money they could lose if the borrower does not pay back their loan, and it helps them decide what interest rate they should charge for that risk to be worth it.

Credit ratings and scores are different. A credit rating is an evaluation of your financial history, while a credit score is a numeric representation of your likelihood of defaulting on a loan.

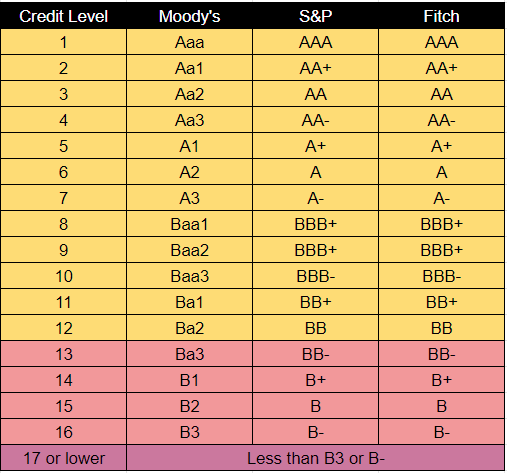

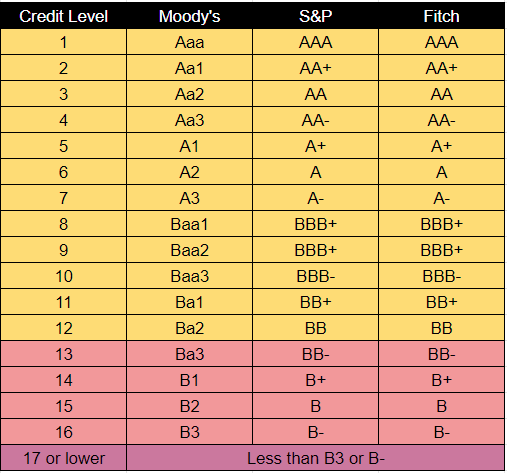

Credit ratings can be provided by a credit bureau, which collects information about your financial history, income, and other factors that determine whether you are likely to repay debts on time. Moody’s, Standard & Poor’s, and Fitch are some of the most widely recognized rating agencies. The Philippine Rating Services Corporation (PRSC) is the country’s only domestic credit rating agency accredited by the Securities and Exchange Commission (SEC).

How is a credit rating calculated?

There are several ways that credit ratings are calculated, but they all include information about your payment history, how much you owe, the length of your credit history, and the types of accounts you have. Credit ratings also consider recent credit activity.

Credit rating agencies use this information to create a score that shows lenders how likely you are to repay their loans. When they make decisions about whether or not to lend money or at what interest rate, they look at the scores from the credit rating agencies. Higher scores mean lower interest rates for borrowers—and better terms for lenders!

Credit ratings can be updated periodically as new information about your financial situation becomes available. The FICO credit rating system is believed to weigh payment history (35%), the amount owed (30%), length of credit history (15%), credit mix (10%), and new credit applications (10%).

Benefits of a higher credit rating

A higher credit rating means you have more options for financing your real estate deals, especially if you are planning to purchase luxury lots in Daang Hari or a condominium in Baguio. You can even have good deals on a house and lot for sale or a pre-selling lot for sale. Some real estate companies, such as Brittany Corporation, check an individual’s capacity to repay amortization.

You can get lower interest rates, better loan terms, and even access to private lenders willing to lend to people with low credit scores. Higher credit ratings also mean that you’ll be able to buy more properties in Brittany Sta. Rosa or in Vista Alabang with the same amount of money. This is because a lender can give you a larger loan at a lower interest rate.

You’ll also save money by paying less interest and fees every month.

What are the different types of ratings?

When you’re looking to borrow money, the lender will want to know that you can pay it back. The lender will look at your credit history and consider how likely you are to repay the loan. This process is known as “credit analysis,” and it’s a way for lenders to get information about how good a borrower’s risk is. The two main types of credit ratings are investment grade and speculative grade.

Investment grade rating is a term used to describe a rating given to an individual or company with strong management and financial capacity. Companies in this category are considered safe investments, meaning they will likely pay back their debts.

The speculative grade is given to individuals or companies who may not be as stable or financially sound as others. These companies will probably not pay back their debts, but they also offer investors the chance at high returns on their investments because they are riskier than other companies.

Major financial institutions use a credit rating system based on the three major credit rating agencies: Fitch, Moody’s, and S&P. Each agency uses its terminology for its ratings. The chart below shows the equivalency between the different agencies’ ratings and relates them to our credit level index.

What is the BBB rating?

The BBB score from Moody’s, which measures an individual, a company, or a government’s ability to meet its financial commitments, suggests that the organization has an adequate but manageable capacity to meet its obligations. While BBB is not as good as an A rating, it.

What is BBB-rated debt?

BBB-rated bonds are considered investment grade, which means that the bond is likely to be paid in full at maturity. This type of bond also has a low risk of default.

The BBB credit rating is given to bonds with a higher risk of default than bonds rated AAA or AA. However, they’re still considered relatively safe investments. The BBB rating indicates a moderate chance that the issuer will default on its obligations due to financial distress or poor management practices.

Is BBB higher than BB+?

When looking at a company’s debt rating, you’ll often see it listed as “BBB” or “BBB-.” The letter in front of that number is what tells you how good the rating is.

So if a company has an A+ rating, its debt is considered very safe—it’s much less likely to default on its obligations than companies with lower scores. If a company has a BB+ rating, its debt is less safe—it’s more likely to default on its obligations.

The difference between BBB and BB+ is small enough that they are interchangeable for most purposes (as far as ratings go). You can check the table above to see how other ratings rank credit ratings.

How do you get a high credit rating?

Getting a high credit rating is like getting a good grade in school. To get a high credit rating, you need to work hard and prepare for the challenges ahead.

Here are some tips for getting a high credit rating:

- Pay your bills on time.

- Don’t close accounts if they’re in good standing—it can hurt your score.

- Keep your balances low, and don’t max out any of your cards—use less than 30% of your available credit at any given time.

- Don’t open too many credit cards

- Consolidate your debt

- Review your credit report regularly and dispute any mistakes or errors

Final Thoughts

Your credit rating is critical to your financial security, and you should never take it for granted. When you understand what goes into your score and how important it is to monitor it, you can rest assured that your credit will be in good hands—and that you’ll be able to make the most of the opportunities that come your way.

Suggested Read: An In-Depth Guide To Getting Pre-Approved For A Home Loan

Suggested Read: What Are The Different Real Estate Financing Options

Suggested Read: How To Maintain A Good Credit Score

Suggested Read: OFW Parents Pre-Retirement Goals

Suggested Read: Build Build Build Project Updates