BLOGS

Economic Recovery Forecast for 2022

The pre-pandemic Philippines was on its way to the top. From the “Build Build Build” infrastructure projects to being described as one of the most dynamic economies in the East Asia Pacific region by The World Bank, the projected years to come were looking brighter than ever. That is, until, the Covid-19 pandemic struck the world, shattering not just the Philippines, but as well as the rest of the world. Only very few industries thrived during this period, such as luxury real estate, retail, and the services sector. Thus the critical economic situation in 2019, which economists have even compared to the 2008 financial crisis. We will discuss these similarities and differences, the pre-pandemic state of the economy, which are key in determining an economic recovery forecast and plan.

Where is the Philippines headed? | Photo by Bambi Corro

The State of the Economy in Pre-Pandemic Philippines

As mentioned above, The World Bank praised the country for its dynamic economy, comparing it to the country’s performance in the previous decade. A report that the organization released, it stated that the average annual growth increased to 6.4% between 2010-2019 from an average of 4.5% between 2000-2009. This is the result of the Philippine government’s efforts to increase urbanization, which resulted in a more vibrant labor market and strong consumer demand. Together with this is the growing middle class of young Filipinos who are more business-minded, influenced by the trends of e-commerce, and inspired by their peers on social media.

Filipinos had many ways of earning a living in pre-pandemic times, especially for an agricultural and tropical country such as this. | Photo by Avel Chuklanov

The industries that are considered untouchable or at least would not be much affected by unforeseen circumstances, such as a global pandemic, include business process outsourcing (BPOs), real estate, tourism (outside of lockdowns), and finance and insurance industries. In fact, real estate, particularly luxury real estate, only thrived during such a critical period of the pandemic. Why? Simply because of the new strong demand for luxury homes that can provide safety, security, exclusivity, privacy, and most importantly, space. Given the health protocols in place as well as the risks to people of all ages and walks of life, families who could afford a luxury house and lot for sale did not think twice about prioritizing the safety of their loved ones. Many families left the busy and crowded Metro Manila for exclusive communities in nearby provinces such as Brittany Corporation’s Crosswinds in Tagaytay and Promenade in Sta. Rosa, Laguna.

Suggested Read: 2021 Economic Outlook And Tips On How To Run Your Business This Year

The Philippine economy has also made progress in delivering inclusive growth, evidenced by a decline in poverty rates and its Gini coefficient. The Gini coefficient is a statistical measure of the degree of variation or inequality represented in a set of values, used especially in analyzing income inequality. An increase in the Gini coefficient suggests that income is becoming more unevenly distributed, and vice versa. Poverty in the Philippines declined from 23.3% in 2015 to 16.6% in 2018 while the Gini coefficient declined from 44.9 to 42.7 over the same period.

The economic recovery forecast made for 2022 during pre-pandemic times was certainly only an increasingly upward movement. That is until the lockdown of 2019.

The Philippine Economy during the 2008 Financial Crisis

The most obvious similarity between the impact of the pandemic and the 2008 financial crisis on the Philippine economy is the spike in inflation and the fragility of the country’s financial system. Taxes have increased remarkably during these times, which burdened the shoulders of the working class to keep up with the business shutdowns that led to sudden unemployment.

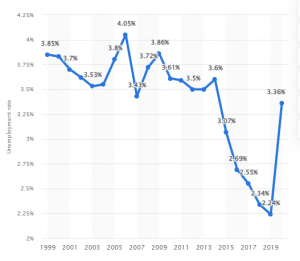

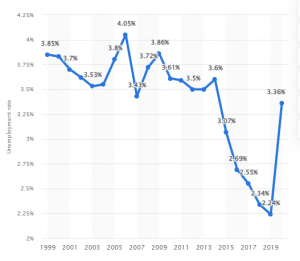

The unemployment rate from 1999 to 2020 in the Philippines

According to the figure above by Statista, the unemployment rate in the Philippines was on a steady downward trend from 3.6% in 2014 to 2.24% in 2019. However, this downward trend changed once the pandemic hit the country. In one year, the progress of the unemployment rate for five years was overturned. In fact, the unemployment rate of 3.36% in 2020 is not far from that of the financial crisis aftermath at 3.86% in 2009.

Despite the unemployment rate being higher after the 2008 financial crisis, we can observe that the impact of the Covid-19 pandemic transcends the country’s financial situation. This is because apart from its impact on the economy, the waves of fear and vulnerability that Filipinos experience due to the increasing cases of the virus made life much more difficult. Aside from those being laid off, workers started leaving their work in order to take care of their family members affected by the virus or looked for remote work to prevent spreading the virus to their loved ones. At the beginning of the pandemic, many engaged in panic buying for groceries and personal protective equipment (PPEs) as well to maintain their resources during the series of lockdowns.

Suggested Read: Why Luxury Real Estate Investment Stands Out In The New Normal

Furthermore, the Philippines endured the longest lockdown in the world. For many Filipinos, hunger was a bigger threat than the virus, since the lockdown forced strict curfews, travel bans, and limited groceries/restaurants/shopping centers especially in Metro Manila. Socioeconomic Planning Secretary Karl Chua said in an interview that with each week of enhanced community quarantine, the Philippine economy lost at least P105 billion along with 444,000 jobs for the duration of the ECQ. Of course, the public health issue must be addressed but the government evidently had its struggles trying to balance both the economy and the pandemic. The race to recover from the Covid-19 pandemic through vaccination programs, emergency responses, and various ad hoc teams such as the COVID-19 Inter-Agency Task Force (IATF) required a huge budget that the government was not prepared for as well.

Economic Recovery Forecast for 2022 in the Philippines

The Philippine economy started to recover in 2021 with a 3.7% year-on-year expansion in the first half of the year. After the lockdowns, investors saw cheaper business opportunities with high demand especially in the retail and food and beverage sectors. Likewise, public investment grew significantly, and more entities saw opportunities in cheaper stocks. Furthermore, continued recovery and reform efforts have prepared a more stable economy as the country experiences the New Normal. The nation is certainly getting back on track, making its way from a lower-middle-income country with a gross national income per capita of US$3,430 in 2020 to an upper-middle-income country (per capita income range of US$4,096–$12,695) in the short term. After all, when the economy crashes and the market is down at its lowest, there is nowhere else to go but up, as history repeats itself.

Suggested Read: 2022 Luxury Real Estate Market Forecast

Tourism is already improving in the Philippines as it is known for its picturesque beaches and landscapes | Photo by Eibner Saliba

The economy expanded by 4.9 percent in the first three quarters of 2021, rebounding from a 10.1 percent contraction over the same period in 2020 despite the implementation of several lockdowns. Public spending accelerated from 23.6 percent of GDP in the first three quarters of 2020 to 24.6 percent of GDP in the same period in 2021, in line with the recovery in public investment and ongoing fiscal support. Infrastructure outlays increased from 3.5 percent of GDP to 4.7 percent of GDP in the first three quarters of 2021, a result of the government’s push on investment spending as part of its recovery program. Albeit slowly, clearly, the country is making progress by investing in infrastructure and revitalizing the workforce.

Suggested Read: The Importance Of Domestic Interest Rates Forecast For 2022

A more revitalized Philippine economy is on its way | Photo by Meo Fernando

We can also observe that companies and the national government itself are preparing for a more pandemic-proof Philippine economy. In a way, the country was forced into a digital transformation, forcing industries to operate online or else be left obsolete due to the pandemic. Now, most stores nationwide operate in stores as well as online, and delivery services have tripled. Home services have also become sensational for families and individuals who are not willing to risk exposing themselves in public places. After all, everything is better from your luxury homes by Brittany Corporation. At least, although everyone is hoping for the best, we do expect the worst that another wave of the virus would take place because of its new variants. In this case, more businesses would be able to adapt to the workforce more comfortable with the work-from-home setup. Right now, even educational institutions have not yet started conducting face-to-face learning, but will soon be establishing new measures now that minors are receiving vaccinations against the virus as well.

Economic growth is expected to further rebound assuming a containment of the virus domestically and globally, an acceleration of mass vaccination pace, and more robust domestic activity bolstered by greater consumer and business confidence and the public investment momentum.

Visit Brittany’s official property page to know more about Brittany’s beautiful thematic offerings or follow us on our Linkedin, Facebook, Twitter, and Instagram accounts!

NEXT READ: Vista Alabang’s Housing Market Sees Strong Price Appreciation

NEXT READ: Where To Buy Luxury Homes In The Philippines