BLOGS

How Real Estate Taxes Work

In the event that you own a house and lot, or if you are considering purchasing a condominium for sale or a house and lot for sale, you will almost certainly be required to pay property taxes. The tax implications of real estate are complicated, which is made even more difficult if you are looking to purchase a luxury home and land package for sale in a desirable location.

Homeowners share in the responsibility, which is why it is critical that you understand the calculations and how they are applied in your area in order to avoid being overcharged or making additional real estate decisions that could put you in a financial bind in the future.

Real Estate Taxes: An Overview

When buying properties for sale, you will also own accountability for at least two types of housing-related taxes:

- Real estate taxes are local government-imposed taxes on properties that should be paid by property owners. Taxable property includes land, structures, improvements to the land and/or structures, machinery; and

-

- Capital gains taxes, also known as profits taxes, are levied on a profit made from an investment when the investment is sold or otherwise realized.

Let us concentrate on real estate taxes for the purposes of this article. As a homeowner, you either pay these taxes directly to the local tax assessor or include them in your monthly mortgage payment.

You pay real estate taxes as long as you own a property

You continue to pay real estate taxes as long as you own your property. Even if you have paid off your mortgage in full or do not live in your house and lot or condo as your primary residence, you must pay real estate taxes on the property as long as it is registered in your name.

Real estate taxes are mandated by law, specifically Republic Act 7160, also known as the Local Government Code. In 1991, this law was passed so local government units or LGUs have the ability to create and collect their own sources of income to finance public expenditures.

Real property taxes are just one of the many sources of income LGUs rely on in order to provide services and projects that will benefit the communities they serve. These services and projects come in the form of emergency services, libraries, schools, roads, and the like.

The formula

When paying for real estate taxes, it is calculated based on the assessed value of your land and any buildings on it. In formula terms, it is expressed as: Real Property Tax (RPT) rate X Assessed Value of the Property.

Tax rates vary according to your property’s location. If your luxury home and lot are located in Metro Manila, the tax rate is 2% of the property’s assessed value. The rate is 1% of the assessed value of provincial real estate.

Expect additional charges

But as always, do expect additional charges on top of the real estate taxes you will need to pay. Apart from the basic real property tax, homeowners will also be charged additional tax for the Special Education Fund. The Special Education Fund amounts to an additional one percent of the assessed value of the real property. This amount specifically funds local schools in your community.

For property owners that own idle properties or properties that are not being used as primary residence or place of business, the LGU charges five percent of the assessed property value, at maximum, in addition to the basic real estate property tax.

But how do you find out how much your property is worth?

The assessed value of a piece of real estate can be calculated by multiplying the fair market value of the property by the assessment level of the property. Ordinances, as prescribed by Section 218 of the Local Government Code, are used to set the assessment levels for each district. This interpretation of assessed value extends to the interpretation of taxable value.

Before diving in to your computations, there are two things to consider: you need to calculate the total assessed value of your property. For house and lot properties, this means determining the assessed value of the home and the residential land it currently is standing on.

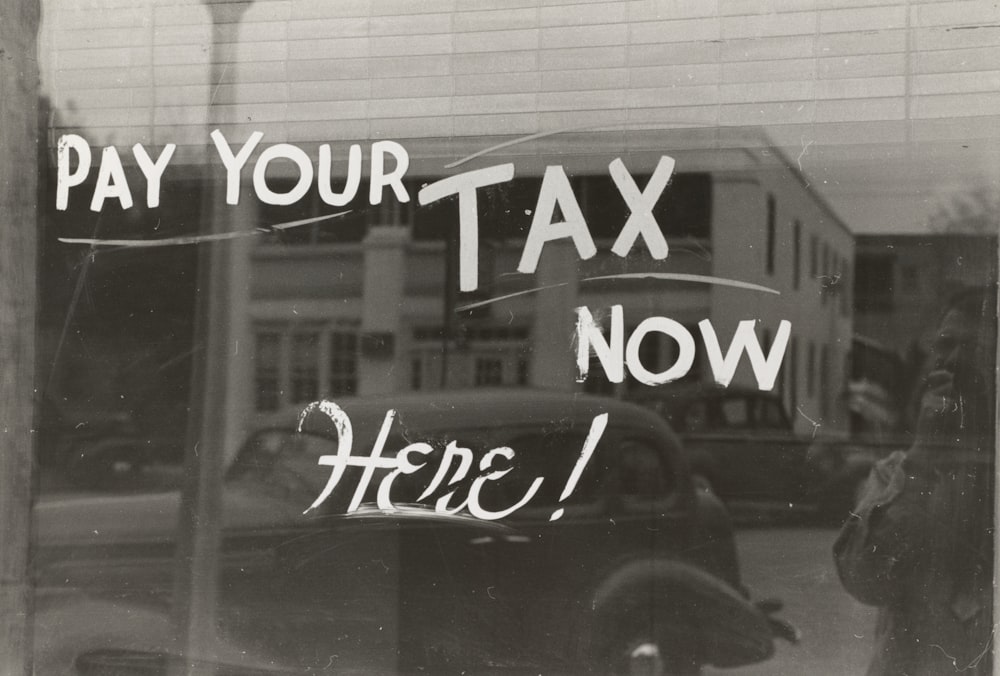

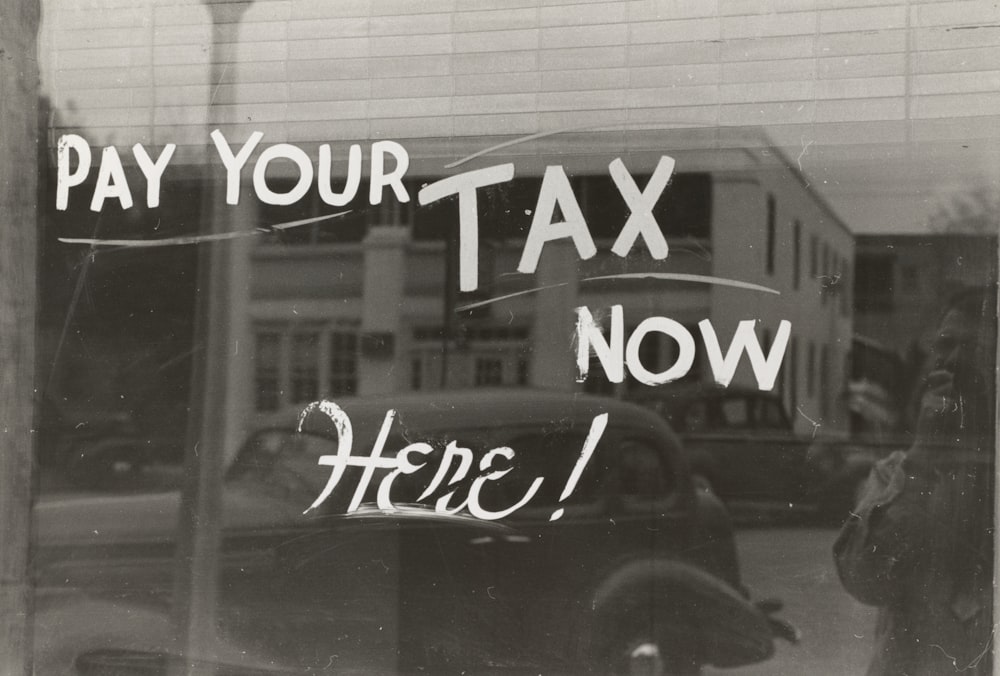

Paying Real Estate Taxes

As you become more familiar with the real estate tax calculations for your house and lot, condo, or luxury home, you get more confident in calculating and managing homeownership expenses. You also get to be more smarter and careful in making home improvements, which may add value (or cost) to your home.

To pay your real estate taxes, you have the option to either pay in full or through quarterly installments.

If you opt for full payment, you have until January 31 of each year to pay your real estate taxes. If you opt for a quarterly payment, you may consult with the following schedules before:

- First-quarter: On or before January 31

- Second-quarter: On or before June 30

- Third-quarter: On or before September 30

- Fourth-quarter: On or before December 31

You can pay your land tax bill in person at the Land Tax Division of your local government unit’s Treasurer’s Office, or you can pay online using one of the payment options listed on this page. It’s possible that you’ll have to register before you can use the online payment option.

There will inevitability be instances in which you are unable to make a payment on time; however, you should not assume that making a payment on time will entitle you to be exempt from penalties. Late real estate tax penalties are calculated at a rate of 2 percent interest per month, with a maximum penalty of 72 percent if you fail to pay your taxes for three years in a row.

Some local governments provide tax breaks to citizens and businesses in order to encourage them to pay their real estate taxes on time. Additional information on paying real estate taxes, as well as any available discounts, can be found on the website of your local government.

Paying Real Estate Taxes on Luxury Properties in the Philippines

Paying real estate taxes can be a pain for some, but if the tradeoff means owning a high-value investment in a prime location, then it’s not that bad considering its many benefits.

To make the most out of every money you spend on homeownership, it is critical that you choose the right location for your luxury condominium or luxury house and lot, whether for your own use or to rent out. This will ensure that the money you spend on homeownership is directed toward increasing the value of your property.

High-end vacation homes can provide a variety of benefits, including increased property value, business networking opportunities, and personal enjoyment, among other things. Additionally, you should think about purchasing a property that will be appealing to vacationing families when making your purchase. Investing in a high-end vacation home is a great way to generate seasonal income, and it can also be a profitable investment during times of strong financial markets.

All that is required is that you choose a good location with a strong market in order for the tradeoff in spending homeownership costs, including real estate taxes, to be financially beneficial.

Brittany Corporation, the premier name in luxury real estate development in the Philippines and a subsidiary of the largest homebuilder Vista Land & Lifescapes, Inc., offers Old European and American-themed projects and creates masterpieces of upscale living for luxury homebuyers with a taste for artful living. Some of its high-value portfolio include premium real estate properties in prime locations that give value more than its price points.

Crosswinds Tagaytay is a Swiss-inspired resort development that spans over 100 magnificent hectares and is home to more than 35,000 towering pine trees. It is the first of its kind in the Philippines.

It is credited with helping to keep Tagaytay cooler than usual during the summer months. Crosswinds Tagaytay offers breathtaking views and vantage points that draw the viewer’s attention to aerial views of the rest of Tagaytay City and Metro Manila, as well as the rest of the Philippines.

When it comes to commanding Swiss-inspired homes and residential buildings nestled along the exclusive community’s natural slopes, Crosswinds Tagaytay is in a league of its own. Upon entering the property, prospective homeowners are transported to an ethereal location complete with lush flora that evokes memories of a popular vacation destination you’d always want to visit again.

With its high-end developments such as Crosswinds Tagaytay, Brittany Corporation continues to provide more than just the aesthetics and comfort associated with luxury real estate developments. In order to elevate the experience and improve the quality of life of its homeowners and guests, Brittany ensures that each real estate development evokes an air of exclusivity while remaining sufficiently distinct.

The Bottom Line

Trying to figure out how to calculate and determine your property taxes can be challenging. It takes knowledge of where to obtain information, an understanding of how taxes are calculated, and knowledge of the dates on which tax bills are sent out and due in order to avoid penalties before you can pay the correct amount of taxes on time. Property owners can aid in their own education by becoming familiar with how taxes are calculated, when the billing cycle occurs, and where they can obtain this information, for example.

Some LGUs offer discounts and other reprieves for homeowners who dutifully pay their real estate taxes as “thanks” to giving back to the community. If more homeowners are dutiful with their taxes, this means more funds are allocated in improving and introducing public services that benefit the community, including your residential enclave, as a whole.

Learn more about Crosswinds Tagaytay and why this real estate development is worth investing.